Financing Growth in a Higher-for-Longer Rate Environment

- Mohammad Kashif Javaid

- Oct 1, 2025

- 6 min read

Introduction: The Cost of Capital Has Changed

The era of ultra-cheap money is over. For much of the past decade, companies around the world grew accustomed to historically low interest rates, abundant liquidity, and investors willing to fund growth at generous valuations. That world has changed. By late 2025, the global economy has settled into what analysts call a “higher-for-longer” environment: interest rates remain elevated, equity markets are cautious, and investors demand more discipline.

For CFOs, this shift is not just an external condition — it is a strategic reality that reshapes how growth must be financed. Every investment, every capital raise, and every financing decision now carries higher costs and tighter scrutiny.

In the GCC, this shift plays out in unique ways. On one hand, the region benefits from strong liquidity through sovereign wealth funds, well-capitalized banks, and governments committed to ambitious diversification agendas. On the other hand, family-owned groups and mid-sized enterprises face tighter lending standards, while equity investors are more selective than ever.

In this new landscape, the CFO’s role is clear: act as the capital architect, designing financing strategies that balance risk, cost, and opportunity.

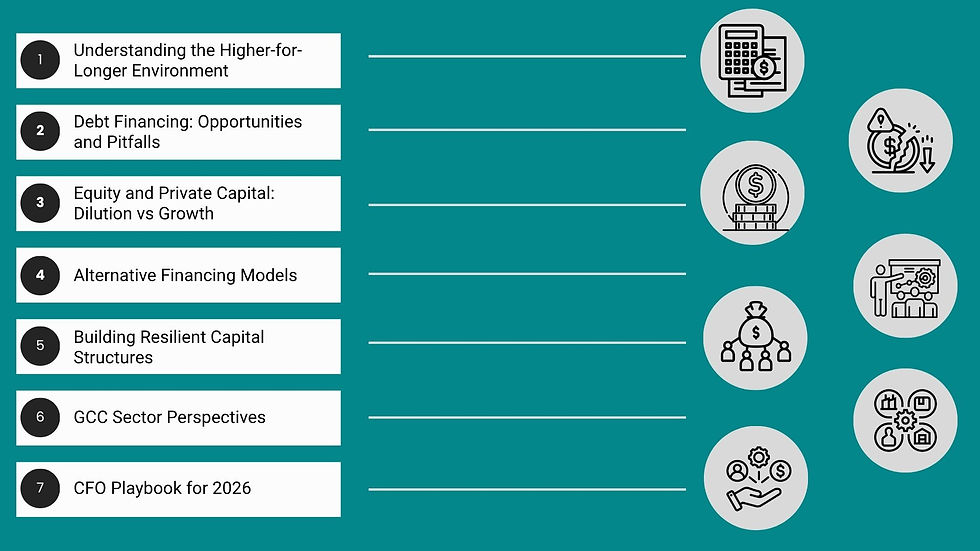

1. Understanding the Higher-for-Longer Environment

Global interest rates remain elevated because central banks continue to prioritize inflation stability over growth stimulus. While inflation has eased from its 2022 highs, policymakers remain cautious after experiencing the damage caused by premature rate cuts in past cycles.

For GCC businesses, the region’s monetary policies — closely tied to the US dollar through currency pegs — mean interest rate paths are largely imported. This leaves CFOs with limited influence over borrowing costs but with significant responsibility for how those costs are managed internally.

The implications are clear:

Debt servicing is more expensive, eating into margins and cash flows.

Valuations are pressured, as investors require higher returns on equity.

Governance and reporting standards are under sharper scrutiny, with investors unwilling to fund poorly managed businesses at premium multiples.

In short, the cost of capital has risen, and the bar for accessing it has risen as well.

2. Debt Financing: Opportunities and Pitfalls

For most GCC firms, bank lending remains the backbone of financing. Yet in a higher-for-longer environment, debt must be approached with caution.

2.1 Bank borrowing under pressure e

Banks remain liquid and willing to lend, but their lending standards are tighter than in the past. Covenants are stricter, collateral requirements are heavier, and repayment schedules are more closely scrutinized. CFOs must approach banks with detailed cash flow projections, stress tests, and clear repayment plans. Family-owned firms that historically relied on relationships to secure lending now find themselves under pressure to meet institutional standards of governance and reporting.

2.2 Sukuk as a strategic option

For larger corporates, Sukuk — Sharia-compliant bonds — offer an increasingly attractive avenue. Sukuk issuances allow companies to diversify funding away from banks and tap into a broad investor base across the Islamic finance world. In 2025, the Sukuk market remains strong, fueled by investor appetite for long-term, compliant instruments.

However, Sukuk are not without cost. Issuance requires transparency, ongoing covenant monitoring, and higher upfront expenses compared to traditional loans. CFOs must carefully evaluate whether the diversification benefits outweigh the complexity.

2.3 Managing leverage risks

The real danger in the higher-for-longer environment is over-leverage. Companies that borrowed heavily during the cheap money era now face rising refinancing costs. Refinancing maturing debt in 2026–27 could squeeze cash flows severely. CFOs must proactively model debt service coverage ratios (DSCR) under multiple scenarios, ensuring that interest and principal payments remain manageable even if revenue slows or borrowing costs rise further.

3. Equity and Private Capital: Dilution vs Growth

While debt costs rise, equity financing is also no longer a straightforward solution.

3.1 Equity at tougher valuations financial lens on AI

Higher rates compress valuation multiples. Where technology or service businesses once commanded 12–15x EBITDA, today investors may offer only 7–9x, particularly for firms without recurring revenues or clear governance structures. Raising equity in this environment often means accepting greater dilution. CFOs must weigh dilution against growth imperatives: sometimes giving up a larger share today is justified if it unlocks market entry or technology investments critical for long-term survival.

3.2 Private equity and venture capital dynamics

In the GCC, private equity firms remain active, but with sharper focus. Consolidation plays in fragmented industries — construction, healthcare, professional services — are especially attractive. Venture capital, which peaked globally in 2021–22, has cooled, but fintech, SaaS, and digital infrastructure remain well funded.

CFOs considering private equity or VC partnerships must prepare for rigorous due diligence, clear exit timelines, and alignment of interests. In many cases, PE firms bring not just capital but also governance structures and strategic discipline that can help family businesses professionalize and scale.

3.3 Sovereign wealth and strategic capital

Perhaps the most distinctive financing channel in the GCC is sovereign wealth funds (SWFs). Entities such as Saudi Arabia’s PIF, Qatar’s QIA, and Abu Dhabi’s Mubadala and ADQ are not only investors but strategic partners. They deploy capital aligned with national transformation agendas: energy transition, smart cities, logistics, and digital infrastructure.

For CFOs, securing sovereign investment requires more than a financial pitch — it demands alignment with national priorities, transparent governance, and a clear contribution to economic diversification.

4. Alternative Financing Models

4.1 Leasing and asset-backed financing

Leasing has gained traction as a practical way to avoid upfront capex. For IT equipment, vehicle fleets, or even industrial machinery, leasing shifts the financing burden from ownership to usage. In Qatar and the UAE, captive leasing arms are increasingly offered by service providers, aligning payment schedules with revenue cycles. For CFOs, leasing reduces initial strain but requires careful management of long-term commitments.

4.2 Joint ventures and partnerships

Joint ventures allow businesses to pool capital, share risks, and accelerate entry into new markets. In GCC infrastructure and renewable energy projects, JVs are common — combining local partners with international expertise. CFOs must ensure JV agreements are carefully structured, with clear governance, exit provisions, and financial transparency.

4.3 Supply chain and vendor financing

For mid-market firms, vendor financing can be a lifeline. Large corporates and government entities increasingly extend financing terms to suppliers, sometimes backed by banks. In industries like construction and telecom, vendor financing reduces pressure on working capital and aligns incentives across the supply chain.

4.4 Islamic finance innovation

Beyond Sukuk, the region continues to innovate in Islamic finance. Murabaha, Ijara, and hybrid structures offer Sharia-compliant flexibility. New fintech platforms are making these instruments more accessible to mid-sized businesses, democratizing access to Islamic capital markets.

5. Building Resilient Capital Structures

A CFO’s ultimate responsibility is to ensure the company’s capital structure is both flexible and resilient.

This means more than just choosing between debt and equity — it means designing a portfolio of financing options that can withstand shocks. Resilient structures typically diversify funding sources (banks, bonds, PE, leasing, JV) and avoid over-dependence on any single channel. They also maintain liquidity buffers, even if it means sacrificing short-term returns, to ensure resilience in volatile conditions.

Scenario planning is essential. CFOs should model financing costs under multiple interest rate scenarios, stress-test refinancing obligations, and build contingency plans. Boards and investors expect this rigor — and CFOs who demonstrate preparedness earn trust and credibility.

6. GCC Sector Perspectives

Different industries in the GCC face different financing realities:

Energy and renewables: Capital-intensive, with heavy reliance on project financing and JVs. Green bonds and sustainability-linked Sukuk are emerging tools.

Real estate and infrastructure: Traditional debt funding is constrained; equity partnerships, REITs, and SWF-backed structures dominate.

Technology and digital ventures: More equity-driven, with PE/VC and corporate venture arms playing central roles.

Services and mid-market businesses: Leaner models benefit from leasing, vendor financing, and disciplined working capital.

For each sector, the challenge is not whether capital exists, but whether CFOs can access it efficiently while meeting investor expectations on governance and returns.1.2 T

7. CFO Playbook for 2026

As CFOs prepare for 2026, financing growth requires discipline, creativity, and foresight. The playbook is clear:

Reassess debt portfolios: Stress-test for refinancing risks and rate volatility.

Diversify funding sources: Don’t rely on a single bank or channel; consider Sukuk, leasing, and JV structures.

Balance equity dilution with growth needs: Sometimes taking capital at lower valuations is necessary to secure strategic opportunities.

Strengthen governance and reporting: High-quality governance is now a prerequisite for capital access.

Align with national visions: In the GCC, funding flows to companies that support transformation agendas.

Conclusion: The CFO as Capital Architect

In today’s environment, CFOs can no longer rely on abundant cheap debt or generous equity multiples. Financing growth has become more complex — but also more strategic. Those who succeed will be the ones who treat capital as a scarce resource, designing resilient, diversified structures that support both growth and resilience.

In the GCC, where transformation agendas demand bold investments, the CFO’s role is pivotal. By acting as capital architects, CFOs can ensure their companies not only navigate the higher-for-longer environment but thrive in it — turning disciplined capital strategies into engines of sustainable growth.

gap

Published by

✅ Strategic Finance Consultant ✅ ACS SYNERGY ✅ At ACS, we help growth seeking businesses with Finance Transformation, Accounting & Finance Operations, FP&A, Strategy, Valuation, & M&A 🌐 acssynergy.com

Follow the link given below to view this article on LinkedIn:

Comments